Overview

If you’re retiring from the Getty, it’s important to consider your future financial and health care needs and your benefit options. The Frequently Asked Questions and Retirement Preparation Checklist can help you understand the steps you need to take.

If you have already retired from the Getty, see the menu on the right to get to information.

If you are vested in the Defined Benefit Retirement Plan at the time of your termination and you have not yet received your benefit, your future benefit will be paid by Pacific Life. You may call Pacific Life with any questions about this benefit at 833-702-1617.

Frequently Asked Questions

I am considering retirement:

When and how can I access my Vanguard funds?

Answer: If you leave the Getty, you have the right to receive your contributions as well as your vested Getty contributions. Contact Vanguard for more information. Certain loans or hardship withdrawals may be permitted while you are employed.

Do I need to apply for Medicare while I’m still working?

Answer: Typically, if you are employed at age 65 and you still receive health coverage through your employer, you can delay enrollment in Medicare Parts A & B until your employer health coverage ends. Visit www.medicare.gov for more information.

How will I receive medical coverage after retirement?

Answer: See Medical Plan — Retirees and Medical Subsidy Plan — Retirees for information.

I am already retired:

How do I change my address?

Answer: Send an email to HR@getty.edu or call 310-440-6523.

How can I contact UnitedHealthcare about my Supplement or Advantage Plan

Answer: Customer service for UHC Supplement Plan is 800-392-7537. Customer service for UHC Medicare Advantage Plan is 800-457-8506.

How can I get more information about my RRA?

Answer: You can log in to your account at www.uhcretireeaccounts.com or call RRA Customer Service at 877-298-2305.

If you have further questions, contact HR@getty.edu.

Retirement Preparation Checklist

Planning for retirement...

Notify your supervisor and Human Resources of your intent to retire. Human Resources should be notified at least 90 days in advance and will set up an appointment with you to discuss your retirement.

Give your new address to HR if you will be moving. Remember to always keep a current address on file with Getty Human Resources.

COBRA options

Consider your COBRA options, if applicable.

Follow the steps below for the Plan(s) you are in.

Follow the steps below depending on your age at retirement:

If you are retiring before age 65:

✓ Consider your medical options.

If you are retiring at age 65 or older:

✓ Contact Social Security.

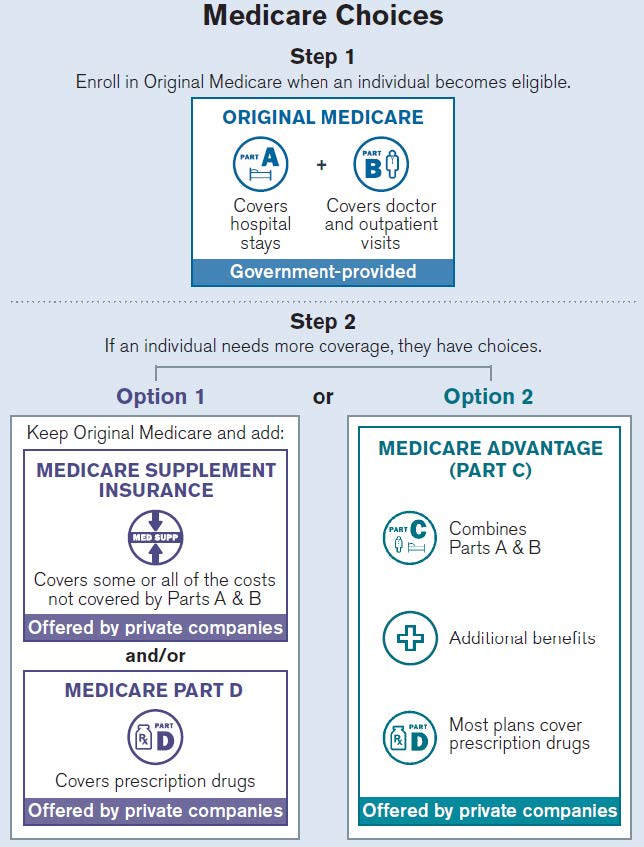

✓ Consider enrolling in a Medicare option. It is suggested that you start the process of enrolling in Medicare three months in advance of your last day. Review Medicare Basics for an overview of your options and eligibility requirements.

✓ Consider enrolling in a Supplement or Advantage Plan, including prescription drug coverage.

✓ Social Security and Medicare Booklets are available in Human Resources. Email HR Benefits for copies.

Frequently Asked Questions

Review Frequently Asked Questions and the Resources available to you.

Receiving Your Retirement Benefit

Your retirement benefit may come from several sources:

- Getty’s Employee Investment Program: If you have money in the 403(b), 401(a) match, and/or non-elective contribution accounts, check Vanguard for up-to-date account balance information.

- Social Security: Visit www.ssa.gov for more information.

- Medicare: Visit www.medicare.gov and see Medicare Basics for more information.

Applying for Your Employee Investment Program Benefits

Visit Vanguard or call 800-523-1188 to initiate a distribution at retirement.

How Your Employee Investment Program Benefit Will be Paid

You have choices concerning how you wish to receive your vested EIP account balances (e.g., leave the money with Vanguard, cash it out or roll it over). You may call Vanguard at 800-523-1188 to discuss.

Medical Plan — Retirees

You may be eligible to participate in the Getty Retiree Medical Plan at retirement if you have met all of the following criteria:

- As of December 31, 2008, you must have reached age 50 AND completed at least five years of benefit service;*

- You must be enrolled in a medical plan through the Getty as an active employee at the time of your retirement;

- You must have a minimum of 10 years of service* in total; and

- You must be employed by the Getty at the time you retire.

* A year of service is defined as a calendar year in which you have completed at least 1,000 hours of service.

Under age 65

Retirees, spouses, and dependents under the age of 65 who qualify for the Retiree Medical Plan will continue to be enrolled in the same health plan offered to active employees until they turn 65. You must pay the premiums for this coverage on a monthly basis by setting up automatic payments via an active credit card. Review the 2026 Medical and Dental Rates. Only dependents covered under a Getty active medical plan at the time your employment ends will be eligible for any future benefit under the Retiree Medical Plan.

OR — You may choose to begin your Retiree Reimbursement Account (RRA) prior to age 65. If you make this choice, it will also apply to your eligible, covered spouse/registered domestic partner. At the time you begin your RRA, your coverage in a Getty active medical plan will end. For more information on the RRA, refer to the “Age 65 or older” section below.

Age 65 or older

Upon reaching age 65, retirees and spouses become Medicare-eligible, and coverage in a Getty active medical plan will end. Retirees and spouses may wish to enroll in a Supplement or Advantage Plan, including prescription drug coverage, to help pay some of the costs that Medicare does not cover. The Getty has a relationship with United Healthcare, which allows Getty retirees to call a dedicated enrollment number in order to learn more about, and enroll in, one of the variety of Medicare supplement insurance plans that United Healthcare offers across the country. However, Getty retirees and spouses are not required to enroll in a plan with United Healthcare.

Note: Only dependents covered under a Getty active medical plan at the time your employment ends will be eligible for any future benefit under the Retiree Medical Plan.

The Getty will provide a Retiree Reimbursement Account (RRA) — a non-taxable account that participants can use to help cover health care expenses, including plan premiums and out-of-pocket expenses such as copays and deductibles. For a list of expenses that are eligible for reimbursement under an RRA, please refer to IRS Publication 502. The Getty sets aside $3,000 per year for the former employee and eligible spouse/registered domestic partner. (This amount is prorated for partial-year enrollments.)

Medical Subsidy Plan — Retirees

If you are not eligible for the Retiree Medical Plan, you will be eligible for the Retiree Medical Subsidy Plan, if you have met all the following criteria at retirement:

- You must be enrolled in a medical plan through the Getty as an active employee at the time your employment ends;

- You must have a minimum of 10 years of service in total*; and

- You must be age 55 or older when your employment at the Getty ends.

* A year of service is defined as a calendar year in which you have completed at least 1,000 hours of service.

Under the Retiree Medical Subsidy Plan, the Getty will provide a Retiree Reimbursement Account (RRA) — a non-taxable account that participants can use to help cover health care expenses, including plan premiums and out-of-pocket expenses such as copays and deductibles. For a list of expenses that are eligible for reimbursement under an RRA, please refer to IRS Publication 502. The Getty sets aside $2,434.80 per year for the former employee. (This amount is prorated for partial-year enrollments.)

Age 65 or older

Upon reaching age 65, retirees become Medicare-eligible. At that time, you may wish to enroll in a Supplement or Advantage Plan, including prescription drug coverage, to help pay some of the costs that Medicare does not cover. The Getty has a relationship with United Healthcare, which allows Getty retirees to call a dedicated enrollment number in order to learn more about, and enroll in, one of the variety of Medicare supplement insurance plans that United Healthcare offers across the country. However, Getty retirees are not required to enroll in a plan with United Healthcare.

Medicare Basics

You and/or your eligible spouse must enroll in Medicare Parts A and B if you are eligible.

You are eligible for Medicare if you are a U.S. citizen or legal resident who has been living in the U.S. for at least five years in a row and are 65 years or older. You may be younger than 65 years old and be eligible for Medicare if you have a qualifying disability.

Other Benefits at Retirement

Understand what happens to your other coverage when you retire.

Dental and Vision Plans

Coverage ends on the last day of the month in which you terminate your employment. Continued dental and vision coverage may be available through COBRA.

If you enroll in a United Healthcare Supplement or Advantage Plan, you may be able to purchase dental and/or vision coverage through United Healthcare.

Flexible Spending Accounts

If you participate in an FSA and retire from the Getty, you will not be able to receive reimbursement for eligible expenses incurred after your last day of work. However, you may continue to submit claims until March 31 of the following year for eligible health care expenses incurred before you retire.

Health Savings Account

If you participate in the HSA and you retire from the Getty, any remaining balance in your HSA account is yours to keep and pay for future medical expenses. You may also move your account to another bank. Contact Inspira at 844-729-3539 for your account balance and additional details.

Group & Voluntary Life Insurance

Coverage will terminate on your last day worked. You may convert this insurance to individual policies after termination and within 31 days from your last day worked.

Auto/Home/Pet Insurance

You may continue coverage under these plans by contacting MetLife at 866-792-4638 or at www.metlife.com/mybenefits (enter “The J. Paul Getty Trust” for company name).

Pre-Paid Legal Services Plan

Coverage will terminate on your last day worked. To continue participating, you must contact Hyatt Legal at 800-821-6400 within 30 days from the last day you worked.

Long-Term Disability Insurance

Coverage will terminate on your last day worked and cannot be converted to an individual policy.

Considerations for Retirees

As a retiree of the Getty, you may still have questions about how your benefits work in retirement. The Getty provides the following information to direct you to the right answers.

- Read about the Retiree Medical Plan or the Retiree Medical Subsidy Plan.

- Review the Frequently Asked Questions.

- Find Important Contact Information.

Resources

Take advantage of these resources to help you manage your retirement:

- Call Vanguard’s general line, 800-523-1188 (800-828-4487 Spanish), to hear about your distribution options.

- Call 800-310-8952 to access Vanguard’s free Ask an Advisor service (you must be logged in to Vanguard when you call).

- Visit www.ssa.gov for information about your Social Security benefits.

- Visit www.medicare.gov to learn more about your Medicare benefits.